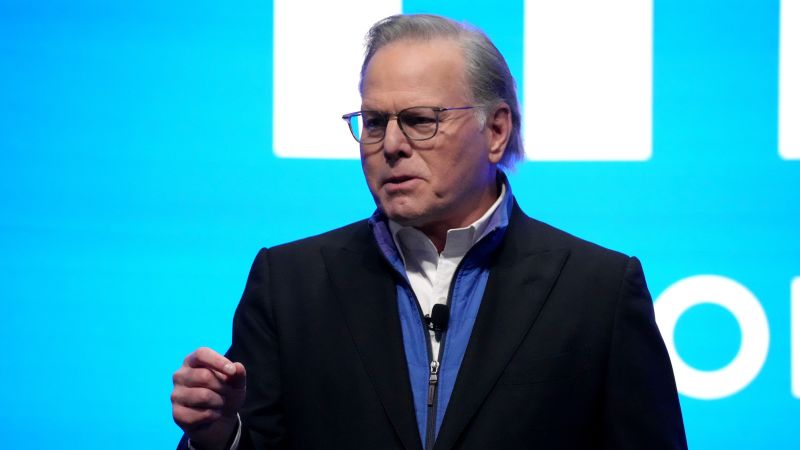

A Conversation with David Zaslav at the Warner Bros. Discovery Foundation on the Future of TV and Streaming Entertainment, Part I: The Case of Hbo Max

I guess the name “Max” makes sense as it favors neither of the two companies and is also aligned with Warner Bros. Discovery Plus will have amish of unscripted shows such as Fixer Upper, along with an array of original shows from Hbo Max, like Succession and The Last of Us.

David Zaslav said thatMax is the one to watch. “It’s the one to watch because it’s the place every member of the household can go to see exactly what they want at any given time.”

The $19.99 per month ad-free Ultimate tier comes with 4K HDR Dolby Atmos for some content, 100 offline downloads, and four concurrent streams, while the $15.99 per month standard ad-free plan offers HD quality, two concurrent streams, and 30 offline downloads. The cheapest ad-supported plan has HD quality and two concurrent streams.

At the event, Warner Bros. Discovery showed off a few Max Originals, including DC’s The Penguin and a new take on The Conjuring. Zaslav also touted the popular franchises that the company owns, like Superman, Batman, Wonder Woman, Game of Thrones, The Lord of the Rings, Harry Potter, Sesame Street, Looney Tunes, and more that it plans on taking advantage of.

The interface of the Max app itself will also come with some improvements. The Warner Bros. Discovery head acknowledged that the Max app has some important flaws, such as a new navigation system, personalized recommendations, and a shortcut to save content, that will be fixed with the new interface. Hopefully, this means Warner Bros. Discovery sorted out the bugginess that comes with the HBO Max app as well.

The goal is to build a streaming service that brings enough of a variety of content to beat out rivals like Netflix and Disney Plus. Zaslav said in an interview with CNBC that the streaming service will succeed because the company owns all the content on the merged app.

The CEO of Disney stated at the time that the company was a great company, but they did not have a portfolio of diverse and appealing content. It could be 400 million homes over the long term.

Warner Bros. Discovery was trying to avoid this type of confusion. During the presentation, Perrette referred to the streaming industry as a teenager still figuring itself out, noting that consumers refer to this time as an “era of peak confusion” when it comes to what service is best for them. Having one streamer with a plethora of Warner Bros. and Discovery content on it will increase the volume of options those viewers have, but it remains unclear whether it will help them make choices.

The new service, announced by CEO David Zaslav at a press event Wednesday, will launch May 23 and give consumers access to a large library of programming across Warner Bros. Discovery’s sprawling portfolio: Warner Bros., HBO, HGTV, Food Network, Cartoon Network, TLC and others.

It’s the one to watch because we have so many of the world’s famous franchises. It’s our strength. The streaming platform is a service “every member of the household” can go to for entertainment, he added.

The content mix is unique to the service and includes award-winning prestige programs like HBO’s Succession and House of the Dragon.

Zaslav also hinted that news and sports programming will factor into the service in the future, given that Warner Bros. Discovery owns properties such as Turner Sports and CNN.

Other companies enmeshed in the cable business have also moved in recent years to launch streaming platforms, including Disney

(DIS), NBC, and Paramount. But none of these companies have achieved the success of Netflix

(NFLX), which pioneered the streaming business and has more than 230 million global subscribers.

As the market gets more saturated, subscriber growth for streaming services has slowed. Some companies have introduced lower-priced ad-supported plans to draw people in.

Profitability is the most important indicator of a company’s success, as executives move to highlight it. It was recently announced by the company that it would stop giving guidance to its members, as they are more focused on revenue.

A year ago this week, one of the biggest mergers in history finally closed. It was the marriage of Discovery and WarnerMedia, a $43 billion deal that formed what’s now known as Warner Bros. Discovery. It wasn’t long before the axes fell. A few weeks later, management shut down the news streaming service CNN+. There were thousands of layoffs. Then, in a move that surprised even close observers, it canned the Batgirl movie and started pulling beloved shows like Westworld from HBO Max.

Warner Bros. Discovery executives clearly know this. Even as they touted Max as a place with something for the whole family, they also, in the words of global streaming president JB Perrette, wanted to “privilege” HBO’s offerings on the new streaming service. At the same time, execs promoted crossover content like Barbie Dreamhouse Challenge, a new HGTV home-renovation series that is, you guessed it, tied to the release of Greta Gerwig’s upcoming Barbie movie. Previously, a winking take on an iconic toy like Barbie would’ve been right at home on HBO Max; having it next to a reno reality series feels like cognitive dissonance.

Consumer choice is something that is touchy for Warner Bros. Discovery. After the presentation, four lawmakers, including Senator Elizabeth Warren of Massachusetts, sent a letter to Attorney General Garland and Justice. They wrote about how the company could adopt potentially anticompetitive practices that could harm workers in labor markets.

WBD announced it’s putting together a bundle of scripted and reality programming at a flat monthly rate. The only meaningful difference: instead of it being distributed through cable by a third-party, it will be transmitted direct-to-consumer over the internet.

A version of this article first appeared in the “Reliable Sources” newsletter. For daily digest on the changing media landscape, sign up.

Is Disney+ a Competing Platform for WBD? Insider Intelligence Analyst Verna: Disney+ isn’t

Disney has done a lot in the streaming space. Insider Intelligence analyst Paul Verna stated to me that the WBD competitor has not entertained the thought of combining Disney+ with other networks. Verna noted that Disney is moving towards each brands core strength, though they do have the ability to purchase individual services in a bundle.